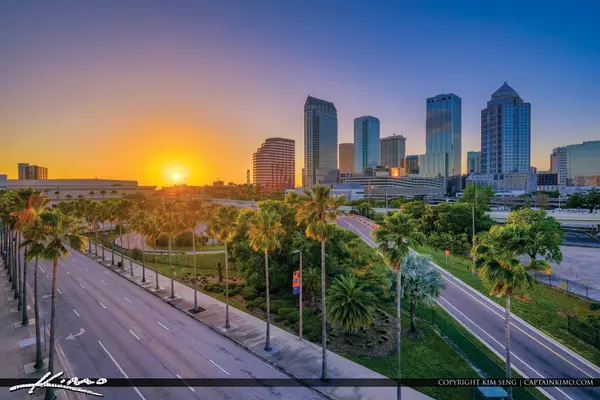

What the Hell is Happening in the Tampa Bay Housing Market? Buyers and Sellers Are Losing Their Minds!

The Florida housing market is shifting, and recent trends offer potential buyers a mix of opportunities and challenges. Whether you're looking to purchase in Tampa Bay or elsewhere in the Sunshine State, understanding the latest data can help you decide if now is the right time to move.

Buyers Returning to the Market

Following the election and a recent interest rate cut by the Federal Reserve, more buyers are stepping back into the housing market. According to Redfin, homebuyer demand increased by 15% in early November, reaching its highest level in over a year. Mortgage rate locks for purchases also surged, more than doubling from a month ago.

This uptick in buyer activity reflects pent-up demand, particularly among first-time buyers who had previously delayed their decisions due to uncertainty. Despite high mortgage rates and elevated housing payments, many buyers are seizing the moment, believing rates won’t drop significantly anytime soon.

Tampa Bay: Key Market Insights

While Florida overall is experiencing shifts, Tampa Bay has its own story:

- Pending Sales Decline: Year-over-year pending home sales dropped by 7.2%, reflecting a cautious market despite growing buyer interest.

- Fewer New Listings: Tampa saw a 10% drop in new listings, indicating a tightening supply even as buyers re-enter the market.

- Price Trends: While some Florida metros like Fort Lauderdale have seen price surges, Tampa’s market appears more stable, providing opportunities for buyers who act quickly.

What Does This Mean for Buyers?

For buyers in Tampa Bay and beyond, the market offers mixed signals. Higher inventory in some areas, coupled with stabilizing prices, can mean more options. However, elevated mortgage rates require careful financial planning.

Key Takeaways for Buyers:

- Act Decisively: With renewed buyer interest, competition may increase for desirable properties.

- Focus on Budget: High borrowing costs can impact affordability—ensure your finances are in order before starting your search.

- Partner with a Realtor: Local market expertise can help you navigate changing trends and identify the best opportunities.

If you’re ready to explore your options in the Florida housing market, now may be the time to start. For more market insights, visit Florida Realtors.

FAQs

Q: Are home prices dropping in Tampa Bay?

A: While some areas in Florida have seen price increases, Tampa’s price trends are stable. Reviewing local sales data will give you a clearer picture.

Q: Is now a good time to buy in Florida?

A: With buyer demand rebounding and interest rates unlikely to fall soon, acting now could help you lock in a home before competition intensifies.

Q: How can I compete with other buyers?

A: Being pre-approved for a mortgage and working with an experienced realtor can give you an edge in today’s market.

Categories

Recent Posts