First-Time Home Buyer Success: How Elizabeth and Salvador Found Their Dream Home in Tampa, FL

A Tampa Bay Real Estate Journey Years in the Making

For Elizabeth and Salvador, buying a home wasn’t something that happened overnight. It was a 9 year journey of preparation, patience, and perseverance — and when the time was finally right, they were more than ready. As a Tampa Bay mortgage broker and real estate professional, I had the honor of helping them turn their dream into a reality.

Building the Foundation: Credit, Budget, and Trust

Elizabeth, a medical assistant working for BayCare in Tampa, and Salvador, who works on the very same bridges we all drive across daily in the Tampa Bay area, had been diligently working toward homeownership. They weren’t just looking for a house — they were waiting for the right one, in the right area, and at a price that made sense for their family.

They had done everything right. Their credit scores were solid, their finances were in order, and they were ready to explore their options as first-time home buyers in Tampa Bay.

Weighing the Loan Options: FHA vs. Conventional

During our initial conversations, we explored several mortgage loan options, including FHA loans, conventional loans, and down payment assistance programs. While programs for first-time buyers can be helpful, we decided that a standard FHA loan would give them the lowest interest rate and more manageable monthly payments.

It was important to me that Elizabeth and Salvador felt confident in every decision, so we reviewed the pros and cons together — no jargon, just real talk.

Partnering with a Realtor Who Understands First-Time Home Buyers

Once they were pre-approved, I connected them with Kristen Biles at Real Broker, a real estate agent who’s phenomenal with first-time buyers. After seeing several homes across the Tampa Bay area, they found the one — a charming home in Tampa FL that had just hit the market.

Kristen jumped into action, called the listing agent directly, and worked her magic to get their offer accepted.

Speedy Pre-Approval and Financing: 3 Days from Contract to Clear to Close

Once the offer was accepted, Elizabeth and Salvador sent me the purchase agreement, and we kicked things into high gear. Within just three days, we had them pre-approved and well on their way to closing. All that remained was the home appraisal.

Home Inspection Nerves and a Simple Solution

Before the appraisal came back, we had to cross another important step — the home inspection. Since the home was built in the early 1980s, the report naturally pointed out some aging systems, like the AC unit. Even though everything was in working condition, the list of recommendations understandably caused a bit of anxiety.

We talked through everything and ultimately settled on a home warranty to provide peace of mind. As a first-time home buyer, the idea of unexpected repairs can be overwhelming, especially when you’re raising a family. The home warranty helped take that weight off their shoulders.

A Curveball: The Power Goes Out

As we waited for the home appraisal — the final green light to get ready for closing — we circled back to review interest rates, closing costs, and the money needed to close. I wanted to keep everything fresh and make sure they were fully prepared.

Then, something unexpected happened.

I got a call from Elizabeth. Their current home had lost power for 2–3 days due to a serious electrical panel issue. Their landlord wasn’t being cooperative, and they were living in the heat with no electricity — no way to cook, no lights, no AC. As a parent myself, I could only imagine how stressed and desperate they must have felt.

They needed to close sooner than expected. So we got to work.

Teamwork in Action: Moving Up the Closing Date

I immediately contacted the title company and United Wholesale Mortgage, the lender issuing their FHA loan. Everyone jumped in — the survey came back the very next day, and our team worked through every compliance detail quickly and efficiently.

By some miracle (and a lot of hustle), we were able to set the closing for the very next day.

A Happy Ending — With an Extra Surprise

And just when we thought things couldn’t get better, they did.

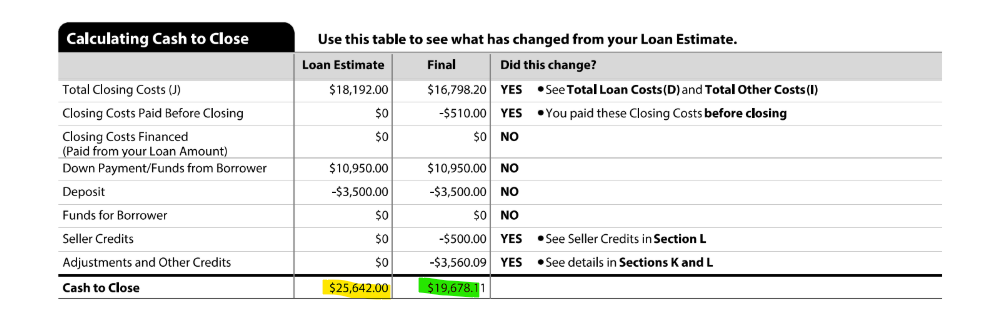

As of the time I’m writing this, I found out that the final amount needed for closing was over $6,000 less (see image below, the yellow was the before estimate and the green was the final). than what we originally expected. I haven’t shared this with Elizabeth and Salvador yet, but I cannot wait to see their faces when I tell them the news.

Helping First-Time Buyers in Tampa Bay is What I Love Most

What an absolute pleasure it was to help Elizabeth and Salvador through this journey — from discussing loan options to moving up their closing date when life threw them a curveball. I'm beyond grateful to have had a trusted realtor partner like Kristen Biles at Real Broker who helped guide them through the real estate side while we handled the financing.

Thinking About Buying a Home in Tampa Bay?

If you're a first-time home buyer in the Tampa Bay area — or if you’ve been waiting for the right time to make a move — I’d love to help. Whether it’s your first home or your fifth, you deserve a team that treats your homeownership dreams like their own.

Let’s connect and make it happen — together.

Categories

Recent Posts