Itinerary for First-Time Homebuyer Workshop

Itinerary for First-Time Homebuyer Workshop

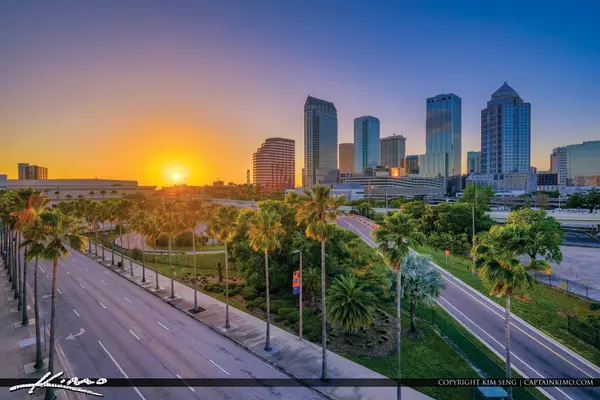

Empowering First-Time Buyers in Florida

1. Understanding Credit for Homebuying

Main Talking Point: How credit impacts home buying eligibility and affordability.

- What is a credit score, and why it matters?

- Minimum credit score requirements for common loan types

- How to obtain a free credit report and review for accuracy.

- Factors that affect your credit score (payment history, utilization, length of credit, etc.).

- Steps to improve your credit score before applying for a mortgage.

- The role of credit inquiries during the homebuying process.

- Addressing past credit issues (e.g., collections, late payments).

- The importance of paying down debt.

- Building positive credit habits for long-term financial health.

- How lenders assess creditworthiness beyond the score.

2. Mortgage Financing Options

Main Talking Point: Finding the right loan product for your financial situation.

- The difference between pre-qualification and pre-approval.

- Overview of common mortgage types (FHA, Conventional, VA, USDA).

- I understand down payment requirements (e.g., 0% for VA, 3.5% for FHA).

- Programs for first-time homebuyers in Florida (e.g., down payment assistance).

- The importance of the debt-to-income (DTI) ratio.

- Questions to ask your lender before committing to a loan.

3. The Homebuying Process: From Contract to Close

Main Talking Point: Step-by-step guide to buying a home in Florida.

- I am deciding on must-haves and nice-to-haves in a home.

- They are choosing a real estate agent and understanding their role.

- The importance of getting pre-approved before house hunting.

- It is essential to understand the home purchase contract and its key terms.

- We are negotiating the offer (price, contingencies, seller concessions).

- The home inspection process and common red flags.

- The appraisal process and how it affects financing.

- I understand the title search and title insurance.

- I am reviewing the Closing Disclosure and preparing for closing costs.

- What to expect on closing day and receiving the keys to your new home.

Scan QR Code for my contact info:

Categories

Recent Posts

Top 7 Reasons to Choose Jose Mejia as Your Downsizing Specialist in Tampa, FL

Top 7 Reasons to Choose Jose Mejia to Sell an Inherited Home in Tampa, FL

Top 7 Reasons to Choose Jose Mejia as Your Relocation Expert in Tampa, FL

Top 7 Reasons to Choose Jose Mejia to Sell Your Home Fast in Tampa, FL

Top 7 Reasons to Choose Jose Mejia as Your First-Time Homebuyer Specialist in Tampa, FL

Top 7 Reasons to Choose Jose Mejia to Sell Your Condo in Tampa, FL

Top 7 Reasons to Choose Jose Mejia as Your Luxury Real Estate Agent in Tampa, FL

Top 7 Reasons to Choose Jose Mejia to Buy a Home in Tampa, FL

Top 7 Reasons to Choose Jose Mejia to Sell Your Home in Tampa, FL

Which Agent Is the Top Choice for Upsizing to a Larger Home in Tampa?

GET MORE INFORMATION

Follow Us