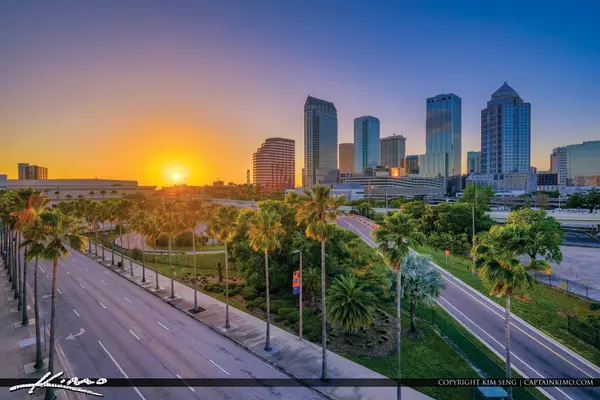

Renting vs. Owning a Home in the Tampa Bay Area: What You Need to Know

As the cost of living continues to rise due to inflation and increases in the consumer price index, many people in the Tampa Bay area face a critical decision: continue renting or pursue owning a home. Both options have benefits and challenges, depending on your income, credit score, and financial goals. This article breaks down the factors to help you make the best choice.

1. Understanding the Costs: Rent Payments vs. Mortgage Payments

Renting often seems easier because it typically involves a straightforward lease agreement with the landlord. However, monthly rent payments do not build equity in a property, which is a significant drawback.

On the other hand, owning a home through a mortgage means that part of your monthly payment goes toward building equity in the property. While mortgage insurance and property tax are additional costs, homeownership can be viewed as an asset that grows over time. Additionally, fixed interest rates protect homeowners from rising rent prices caused by increased demand and limited inventory of affordable housing.

Your income and credit score are crucial in renting and home buying. For renters, landlords or property managers often require proof of income and perform credit checks before signing a lease.

For aspiring homeowners, qualifying for a mortgage requires a solid credit score and a stable income. Lenders use these factors to determine loan eligibility, interest rates, and potential fees like mortgage insurance. If you have good credit and financial stability, owning a home may be a more viable and long-term solution.

Renters typically only need to worry about their monthly rent and utility bills. However, renting comes with potential expenses like security deposits, late fee charges, or penalties for breaking a contract.

Homeownership includes additional costs such as property tax, maintenance, and insurance. However, working with a reliable real estate agent can help you find an affordable home within your budget. Additionally, homeowners can generate passive income by renting out a portion of their property—something renters cannot do.

The Tampa Bay real estate agent community has noticed a surge in demand for housing due to rising wages and population growth. However, with inflation and increasing interest rates, affordability remains a challenge. The rising consumer price index reflects how the cost of property management, taxes, and maintenance has escalated, directly impacting renters and homeowners.

For renters, landlords often raise rents to keep up with inflation and increased operating expenses. On the other hand, homeowners may lock in lower interest rates through fixed mortgages, providing long-term stability in housing costs.

5. Equity and Long-Term Benefits

When you rent, you pay your landlord’s mortgage and help them build equity in the property. However, when you own a home, your monthly payments build equity for yourself, turning your home into a valuable asset. Over time, homeowners can leverage equity for other financial opportunities, like paying off debts or investing in additional properties.

6. Choosing What’s Right for You

Deciding between renting and owning a home comes down to your financial situation, goals, and methodology for evaluating costs. If saving for a down payment or improving your credit score feels daunting, renting might be a temporary solution while you prepare for home buying.

However, if you’re ready to invest in your future, working with a professional real estate agent can simplify finding an affordable home in Tampa Bay. With expert guidance, you can evaluate all the options and decide what works best for your budget and lifestyle.

Final Thoughts

Whether you choose to rent or own, understanding the price index, current market conditions, and overall cost of living is essential in today’s economy. You can determine which path aligns best with your needs by analyzing your income, potential expenses, and long-term goals. If you’re ready to explore home buying or need help navigating the market, contact a qualified real estate agent in the Tampa Bay area to get started today!

Categories

Recent Posts