How Paige Used Her VA Loan to Buy Her First Home in Tampa—And Skipped Paying Property Taxes!

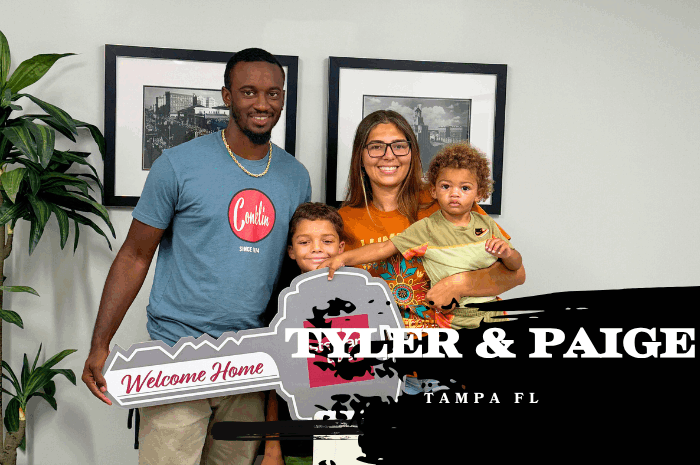

Buying your first home is always exciting—but when you’ve got a VA loan, a little bit of insider knowledge, and a fiancé who just popped the question on the 4th of July? Now that’s a story worth sharing.

Let me introduce you to Paige, a first-time homebuyer and proud veteran who just bought her dream home in Tampa Bay—and did it smarter than most!

From Fireworks to Front Door Keys

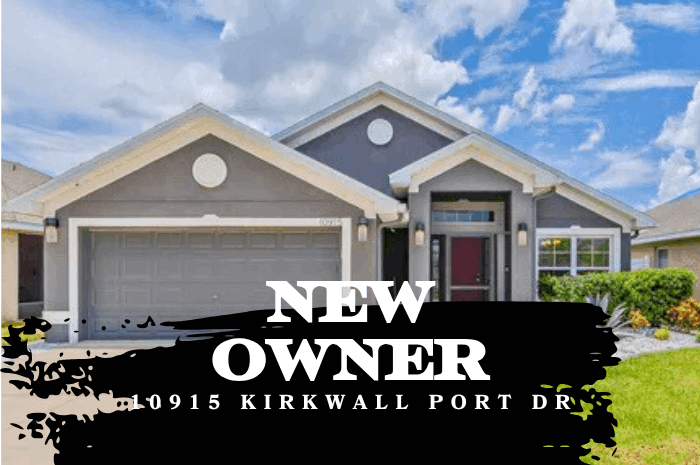

Paige is originally from North Carolina but was stationed in Alabama, where she met her now-fiancé, Tyler. On July 4th, he got down on one knee 💍—and just weeks later, they closed on their beautiful new home at 10915 Kirkwall Port Dr, Wimauma, FL 33598. 🇺🇸

So yeah, life came at them fast—but in the best way possible.

VA Loan Power Play: Paige's Homebuying Wins

Here’s where Paige’s homeownership story stands out:

First-Time Buyer, VA Loan Winner

As a first-time buyer, Paige knew the VA loan was her best bet. No down payment, no private mortgage insurance, and flexible credit requirements? Yes, please.

But here’s the thing…

Most mortgage lenders would’ve had her pay property taxes in her monthly payment, even though she was eligible to have them fully exempted as a 100% disabled veteran.

Not on our watch.

We Got Her Property Taxes Removed Before Closing

Instead of telling Paige to wait until after closing to apply for the Florida Disabled Veterans Property Tax Exemption, we made sure everything was lined up beforehand.

🔒 Result: Her mortgage payment was tax-free from Day 1.

That’s hundreds of dollars saved every single month, starting immediately.

You can learn more about that exemption here:

👉 Florida Department of Revenue – Property Tax Exemptions

Behind the Scenes: VA Loan Worksheet Tips

Here’s what most lenders don’t tell you…

The VA loan uses something called a residual income worksheet to make sure borrowers can afford their monthly obligations.

With Paige’s 660 credit score, we still locked her into a 6.0% interest rate by structuring her file strategically.

💡 We used less-known qualifying techniques in the VA worksheet to boost her residual income and qualify smoothly—even when other lenders might’ve said no.

New Beginnings in Wimauma, FL

Now Paige and Tyler are officially homeowners—starting a new chapter in sunny Wimauma, just south of Tampa. With no property taxes in her mortgage and a low monthly payment, they’ve set themselves up for long-term success.

Whether they’re planning their wedding, decorating their new space, or just soaking up that Florida sunshine—this couple is starting strong.

Want to Buy a Home with Your VA Loan?

If you’re a veteran in Florida, especially if you qualify for a 100% disability rating, we need to talk before you buy.

📌 You may be able to remove your property taxes from your monthly mortgage payment—but only if your lender knows how to work the system.

At holawesleychapel.com, we help VA buyers like Paige maximize their benefits, buy smarter, and save big from the start.

Let’s Get You Home

👉 Contact me here to schedule a free strategy call.

📲 Or follow me on Instagram for more VA loan tips, success stories, and Florida home tours.

Categories

Recent Posts